Oil edged lower on signs that the US and Iran have made progress in nuclear talks, eroding a risk premium in benchmark futures prices.

West Texas Intermediate fell to settle near $62 a barrel after Iranian Foreign Minister Abbas Araghchi said that the two countries reached a “general agreement” on the basis of a potential nuclear deal that would lift sanctions on Tehran and ease the risk of war in the Middle East. Tehran’s negotiators are scheduled to return with a new proposal in two weeks, a US official said Tuesday.

Success in the talks could pave the way for a lasting removal of a geopolitical risk premium that has kept prices elevated since the start of the year amid rising global oil supplies.

The development erased earlier gains after Iran said it would shut parts of the Strait of Hormuz for several hours due to military drills, though traders were skeptical of a meaningful disruption to the waterway that ships about a fifth of the world’s barrels. The US has also sent a second aircraft carrier to the region.

The two sides will each draft and exchange texts for a deal before setting a date for a third round of talks, Araghchi said, cautioning that the next stage would be “more difficult and detailed.”

US Vice President JD Vance said Tuesday that negotiations with Iran went well but the country has not yet acknowledged President Donald Trump’s red lines.

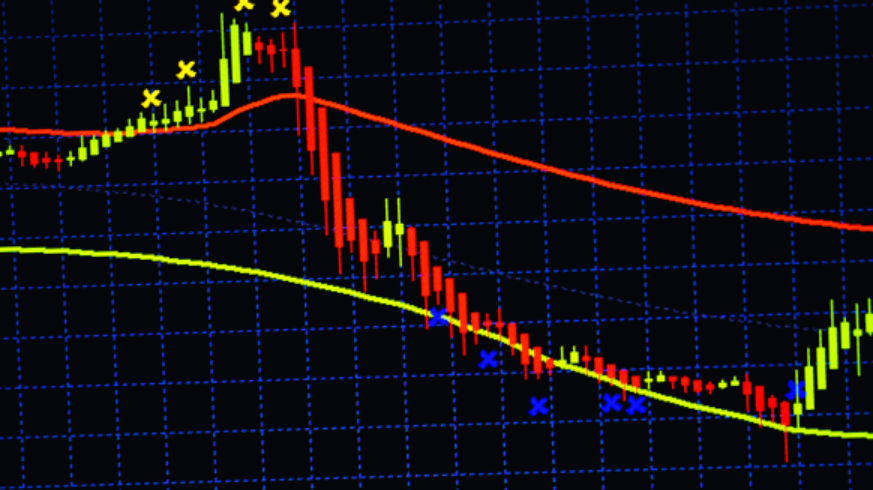

Trend-following commodity trading advisers positioned in WTI breached several sell triggers near $62 a barrel, accelerating the price slide, according to data from Kpler’s Bridgeton Research Group. The robot traders liquidated long positions to sit at 27% short in WTI on Tuesday, compared with 45% at the start of the session, the firm said.

Negotiations are also scheduled between Russia and Ukraine in Geneva over the next two days. However, the prospects of a speedy end to the almost four-year-old conflict and the return of Russian barrels look slim.

Crude is up almost 10% so far this year thanks to a combination of supply disruptions, geopolitical risk and a buildup of sanctioned barrels. While futures have settled in a band between $61 and $65 for most of this month, the outcome of the flurry of diplomatic efforts in the coming days and hours could dictate the path forward for prices.